Union Budget 2024: In this article we will tell you about union budget 2024 latest highlights, income tax, expectations, date & time live update. Finance Minister Nirmala Sitharaman presented the Union Budget 2024, focusing on infrastructure development and education. The budget allocates ₹11.1 lakh crore for capital expenditure, an 11% increase from the current fiscal year.

In the education sector, the budget proposes to establish 100 new Sainik Schools, with a focus on improving access to quality education. Additionally, the government plans to launch a new initiative, “Pradhan Mantri Kaushal Vikas Yojana 4.0,” to enhance skill development and vocational training.

Union Budget 2024 Date

The budget also emphasizes the importance of green energy, with allocations for wind energy, coal gasification, and biomass aggregation machinery.

These initiatives aim to drive economic growth, create jobs, and promote sustainable development. The budget’s focus on infrastructure and education is expected to have a positive impact on the country’s future.

Union Budget 2024 Main Highlights

Here are the highlights of the Union Budget 2024 presented by Finance Minister Nirmala Sitharaman:

- No change in income tax slabs: There has been no change in the income tax slabs.

- Capital expenditure: Capital expenditure for the next fiscal has been set at Rs 11.1 lakh crore, 11% higher than the current fiscal.

- Fiscal deficit target: The fiscal deficit target for FY24 has been revised from 5.9% to 5.8% of GDP, with a target to reduce it to 5.1% for FY25 and to 4.5% by 2025-26.

- Tax exemption: Tax exemption for start-up investments made by sovereign wealth funds has been extended till March 31, 2025.

- Agriculture: The government will promote investment in post-harvest activities by both the private and public sectors, as well as efforts to control foot and mouth disease and expand the use of nano-DAP across all agro-climatic zones.

- Healthcare: Health facilities under Ayushman Bharat will be extended to all ASHA and Anganwadi workers, along with plans to set up hospitals in all districts and vaccinate girls aged 9-14 years for cervical cancer.

- Education: The education budget for 2024/25 is estimated at Rs 1.25 lakh crore, 14.5% higher than the revised estimate for 2023/24.

- Housing: A new housing scheme for the middle class was launched, with a target to build 2 crore houses under the Pradhan Mantri Awas Yojana.

- Energy: The Budget has allocated funds for viability gap funding for wind power, setting up of coal gasification and liquefaction capacities, phased mandatory blending of CNG, PNG and compressed biogas, and financial assistance for purchase of biomass aggregation machinery.

Union Budget 2024 Benefits

- Education Loans: The government has announced that it will provide loans of up to Rs 10 lakh for higher education at domestic institutions. This will be given directly to 100,000 students every year, with an annual interest subvention of 3% of the loan amount.

- Internship Program: The government will launch a scheme to provide internship opportunities to 1 crore youth in 500 top companies. The internship allowance will be Rs 5,000 per month, and there will be a one-time assistance of Rs 6,000.

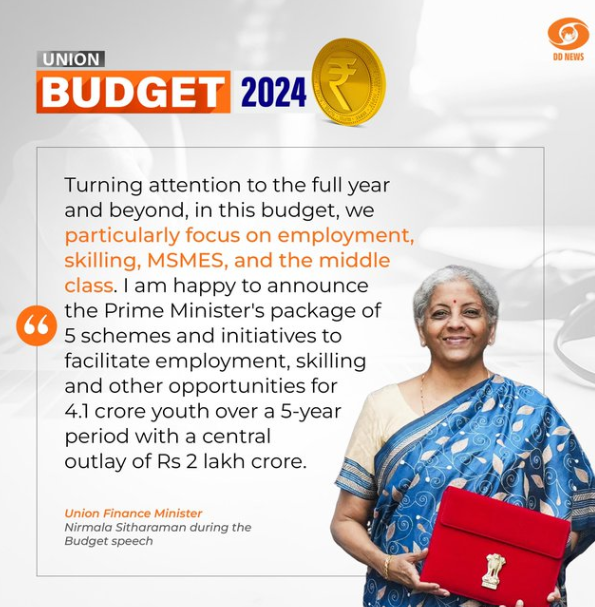

- Employment Opportunities: The government has announced a prime minister’s package of 5 schemes and initiatives to facilitate employment, skilling and other opportunities for 4.1 crore youth over 5 years with a central outlay of Rs 2 lakh crores.

- First-Time Employees: The government will provide a direct benefit transfer of one month’s salary in three installments to first-time employees as registered in the EPFO, up to Rs 15,000. The eligibility limit will be a salary of Rs 1 lakh per month. The scheme will benefit 210 lakh youth.

FAQ’s

An interim budget is a temporary financial blueprint designed to cover expenditures for a short period, usually until a new government takes office. A comprehensive budget for the remainder of the fiscal year will be introduced in July.

1.Tax benefits for startups, investments made by sovereign wealth, pension funds to be extended to March 2025

2.The tax rates for direct and indirect tax remains unchanged, as no proposals were made

3.GDP growth at around seven per cent

4.Revised estimate of fiscal deficit is 5.8 per cent of GDP

5.FY 25 fiscal deficit pegged at 5.1 per cent; aim to reduce fiscal deficit below 4.5 per cent by FY26