CSSRD Scheme Central Bank of India 2024:

cssrd scheme loan 2023 | cssrd loan scheme in hindi | CSSRD Scheme Central Bank of India

If you are an account holder of Central Bank of India, then you too must have thought of opening a Fixed Deposit in Central Bank of India at some point or the other. Then it becomes necessary for you to know what are the fixed deposit interest rates of Central Bank of India, what is the fixed deposit scheme of CSSRD Scheme Central Bank of India 2023 @centralbankofindia.co.in?/cssrd scheme 2024 how much interest will be earned on Central Bank of India, how to get FD in Central Bank of India Do it.

Central Bank of India is a government bank. It was started in the year 1911 as ‘Central Bank of India’. It is the oldest and first Indian commercial bank in India. It has around 4608 branches across the country. It is operated by the Ministry of Finance, Government of India.

Central Bank of India (CBI) is an Indian nationalized bank. It is owned by the Ministry of Finance, Government of India and is one of the oldest and largest nationalized commercial banks in India.

Short details of cssrd scheme 2024

| Scheme Name | CSSRD Scheme Central Bank of India |

| Bank Name | Central Bank of India |

| State | All States of India |

| Official Website | entralbankofindia.co.in |

Central Bank of India Domestic Term Deposit Interest Rates (% प्रतिवर्ष)

घरेलू सावधि जमा ब्याज़ दरें – (2 करोड़ रुपये से कम जमा के लिए)

| परिपक्वता अवधि | सामान्य नागरिक | वरिष्ठ नागरिक |

| 7-14 दिन | 4.00% | 4.50% |

| 15-30 दिन | 4.25% | 4.75% |

| 31- 45 दिन | 4.25% | 4.75% |

| 46-59 दिन | 4.50% | 5.00% |

| 60-90 दिन | 4.50% | 5.00% |

| 91-179 दिन | 5.00% | 5.50% |

| 180-270 दिन | 5.50% | 6.00% |

| 271-364 दिन | 5.50% | 6.00% |

| 1 वर्ष से 2 वर्ष से कम | 6.75% | 7.25% |

| 2 वर्ष से 3 वर्ष से कम | 6.50% | 7.00% |

| 3 वर्ष से 5 वर्ष से कम | 6.25% | 6.75% |

| 5 वर्ष से 10 वर्ष तक | 6.25% | 6.75% |

सेंट्रल बैंक ऑफ इंडिया Fixed Deposit Rates (% प्रतिवर्ष)

सेंट्रल बैंक ऑफ इंडिया सावधि जमा ब्याज दरें – (2 करोड़ रुपये से 10 करोड़ रुपये)

| परिपक्वता अवधि | सामान्य नागरिक | वरिष्ठ नागरिक |

| 7-14 Day | 4.50% | 5.00% |

| 15-30 Day | 4.50% | 5.00% |

| 31- 45 Day | 5.00% | 5.50% |

| 46-59 Day | 5.00% | 5.50% |

| 60-90 Day | 4.00% | 4.50% |

| 91-179 Day | 5.00% | 5.50% |

| 180-270 Day | 5.75% | 6.25% |

| 271-364 Day | 5.75% | 6.25% |

| 1 वर्ष से 2 वर्ष से कम | 6.50% | 7.00% |

| 2 वर्ष से 3 वर्ष से कम | 6.00% | 6.50% |

| 3 वर्ष से 5 वर्ष से कम | 5.50% | 6.00% |

| 5 वर्ष से 10 वर्ष तक | 5.50% | 6.00% |

Special Term Deposit Interest Rates (% प्रतिवर्ष)

| Duration | Common Citizen | Senior Citizen |

| 444 Day | 7.35% | 7.85% |

| 555 Day | 7.00% | 7.50% |

| 999 Day | 6.50% | 7.00% |

सेंट्रल बैंक ऑफ इंडिया टैक्स सेवर डिपाजिट

Central Bank of India Tax Saver Deposit

| कार्यकाल | नियमित नागरिक |

| 5 Years | 6.25% |

सेंट्रल बैंक ऑफ इंडिया NRI FD दरें

| अवधि | NRE FD दरें (2 करोड़ रुपये से कम) | NRE FD दरें (2 करोड़ रुपये से 10 करोड़ रुपये) |

| 1 वर्ष से 2 वर्ष से कम | 6.75% | 6.50% |

| 2 वर्ष से 3 वर्ष से कम | 6.50% | 6.00% |

| 3 वर्ष से 5 वर्ष से कम | 6.25% | 5.50% |

| 5 वर्ष से 10 वर्ष तक | 6.25% | 5.50% |

Documents Required for Central Bank of India Business Loan

- Proof of Identity: Voter’s ID Card/Passport/Driving License/PAN Card/ Signature of Proprietor’s Present Bankers, Partners of Director (if any company) as proof of identity.

- Address Proof: Recent Telephone Bill, Electricity Bill, Property Tax Receipt / Passport / Voter ID Card of Proprietor, Partner of Director (if any company)

- proof of business address

- Last 3 years balance sheet of units along with income tax/sales tax returns etc. (Applicable for all cases of Rs.2 lakh and above). However, for cases below the fund based limit of 25 lakhs, if audited balance sheets are not available, unaudited balance sheets are also acceptable as per extant instructions of the Bank.

- Copy of Sales Tax/VAT/Any other tax registration.

- Memorandum and Articles of Association of the Company / Partnership Deed of Partners etc.

- Details of assets and liabilities of promoters and guarantors along with Income Tax Return (ITR).

Bank से Home Loan कैसे लिया जाता है?

सेंट्रल बैंक ऑफ इंडिया से बिज़नेस लोन कैसे प्राप्त करे

- To take a business loan from Central Bank of India, you must first go to its official website.

- Now the home page will open in front of you, here you will see the option of MSME>>>Apply For BG And LC you have to click on this option.

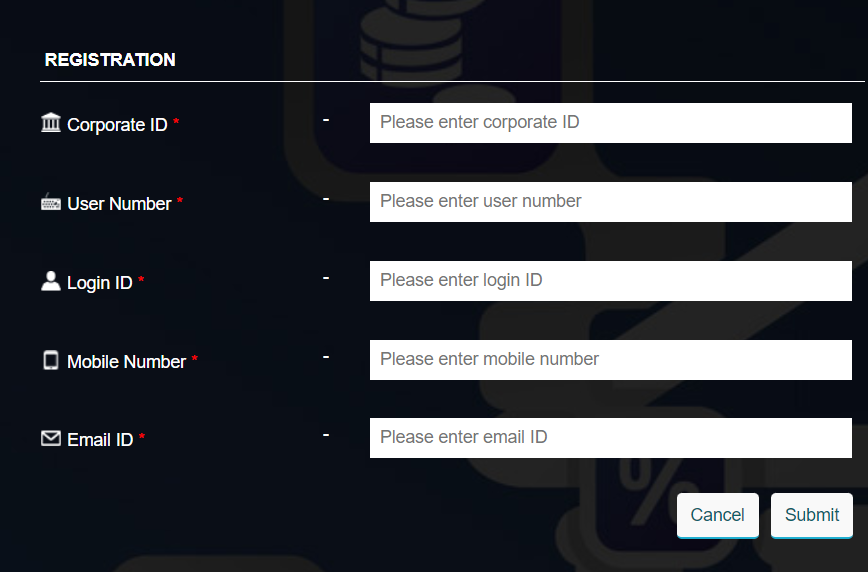

- Now you have to click on the option of Register.

- Now filling all the information you have to click on the Submit button.

- Now you will get user id and password, now you have to login with the help of this.

- Now an OTP will come on the number given by you, which you have to file and proceed.

- Now an application form will open in front of you, here you will have to fill all the information asked.

- After filling all the details you have to upload the documents and click on submit.

- After some time a call will come on your mobile from the bank in which you will be asked about the loan and will be told about the further process.

Summary:

Through this bank, you can take a business loan ranging from Rs 10,000 to Rs 5 crore. Central Bank of India has set up special MSME branches for easy access of credit facility to the entrepreneurs. So that the business people do not have any problem in taking loans.

FAQs

All customers can easily open FD with Central Bank of India for a minimum period of 7 days and maximum of 10 years.

The highest Fixed Deposit (FD) of CSSRD Scheme (Central Bank) interest rate offered is 6.75% per annum.

The official website of cssrd scheme Central Bank of India is centralbankofindia.co.in